Oil is a crucial and highly valued commodity that plays a pivotal role in the world. It is fundamental in powering vehicles, heating homes, and producing everyday items like plastics and pharmaceuticals. Its importance also stems from its role as a key energy source and its part in determining economic stability, influencing everything from inflation rates to national growth.

This article offers an in-depth exploration of oil trading, covering its foundational significance, historical evolution, and the various trading strategies and insights. It’s a comprehensive guide for those interested in navigating oil trading’s complex yet rewarding world.

Key Points

- Oil trading involves buying and selling via platforms, covering physical commodities and financial instruments like futures and ETFs, driven by geopolitical, environmental, and economic trends.

- Its high volatility, liquidity, and diverse financial instruments offer substantial opportunities for traders, highlighting oil’s role in global economy and investment.

- Involves speculating on price changes using strategies with futures, options, and ETFs, requiring knowledge of factors like OPEC decisions, global economy, and geopolitical events.

What is Oil in Trading?

Oil in trading, refers to the process of buying or selling oil via trading platforms. Trading oil is not just about the physical commodity; it encompasses a range of financial instruments like futures, options, exchange-traded funds (ETFs) and contracts for difference (CFDs).

Oil commodity trading is an intricate part of the financial sector, offering opportunities for investment based on the anticipated price movements of oil. Investors often take into account geopolitical events, environmental conditions, global economic trends that influence its supply and demand.

Why Trade Oil?

There are several reasons for investors and traders to consider oil trading:

1. High Volatility

The oil market is known for significant price fluctuations, offering substantial trading opportunities. This volatility is often influenced by global events, appealing to those interested in world affairs. Additionally, the dynamic nature of the oil market, with its rapid responses to geopolitical, environmental, and economic news, provides traders with the chance to capitalise on these changes through timely and informed trading decisions.

2. Market Liquidity

Oil trading is characterised by high liquidity, meaning traders can easily enter and exit positions. This is due to the vast number of participants and the sheer volume of trades, which allows for large transactions to be executed without significant price deviations.

This ensures smoother trading experiences and more stable prices. This aspect is potentially beneficial for both short-term and long-term investors.

3. Versatility in Trading Instruments

Traders have access to a variety of financial instruments such as futures, options, and CFDs, which allow for diverse oil trading strategies and effective risk management.

This range of instruments caters to a wide array of investment objectives and varying levels of risk tolerance, making oil trading accessible and adaptable to the needs of different investors and traders.

4. Global Demand and Strategic Importance

Oil is a vital commodity in the global economy, offering investment opportunity and growth potential due to its consistent demand and central role in various sectors.

Its strategic importance extends beyond energy markets to geopolitics and international relations, significantly influencing global economic stability. The oil market’s accessibility, through nearly 24-hour trading and diverse financial instruments, also makes it an attractive option for portfolio diversification and for hedging against economic uncertainties.

How Does Oil Trading Work?

Oil trading is a process where traders buy and sell oil to make returns from its price changes. It works by traders speculating whether the price of oil will rise or fall, and then buying (going long) or selling (going short) accordingly.

Oil companies involved in extracting and refining oil often participate in trading to mitigate risks associated with price fluctuations.

Oil Futures

Oil futures offer a method for traders to buy or sell a specific amount of oil at a predetermined price on a set future date.

These contracts are traded on major exchanges and are used for both hedging against price fluctuations and for speculative purposes. When trading oil futures, traders are essentially entering an agreement to purchase or sell oil at a predetermined price at a future date, regardless of the market price at the contract’s maturity.

Oil Options

Oil options provide traders the right, but not the obligation, to buy or sell oil at a predetermined price before a specific date. Particularly valuable in the volatile oil market, these options, including call options for buying and put options for selling, help manage uncertainty and limit losses, while enabling traders to capitalise on favourable price changes.

In the volatile oil market, options are crucial for managing risk, offering traders the ability to limit losses and leverage favourable price shifts. Both call options (for buying oil) and put options (for selling oil) are widely used in the market, catering to different trading strategies and market expectations.

Oil ETFs

Oil Exchange-Traded Funds (ETFs) present a straightforward and efficient way for investors to participate in the oil market. These funds mirror the performance of oil markets or sectors, allowing investors to gain exposure to oil price movements without the intricacies of futures or options trading.

By purchasing shares in an oil ETF, investors are offered a diversified approach to oil investment in a variety of oil-related assets, spreading their risk across different companies or commodities within the oil sector.

Oil Stocks

Investing in oil company stocks is another way to trade in the oil sector.

When you buy stocks of an oil company, your investment’s success is linked to the company’s performance and the overall health of the oil market. It is a more targeted way of investing compared to ETFs or futures, offering potentially higher rewards but also higher risks.

Investors in oil stocks need to stay informed about global oil prices, industry shifts, and the specific challenges and opportunities faced by the companies they invest in.

Oil CFDs

Oil CFDs are financial derivatives that allow traders to seize trading opportunities on price movement of oil by speculating on the rising (going long) or falling price (going short).

In oil CFD trading, you agree to exchange the difference in the price of oil from when the contract is opened, to when it is closed. This type of trading is popular for its flexibility, allowing traders to make potential returns from both rising and falling markets.

CFDs provide traders with flexibility but it does come with their own set of risks and may not be suitable for all. Interested in starting CFD trading? Open a live account with Vantage today and begin trading in oil CFDs.

Oil Cash CFDs

Oil cash CFDs are a type of oil CFD trading that is based on the spot price of oil, representing the current market price at which oil can be bought or sold.

Oil Future CFDs

Oil futures CFDs are contracts that speculate on the future price of oil, mirroring the dynamics of oil futures markets without the requirement of buying or selling the underlying asset at a future date.

Oil ETF CFDs

Oil ETF CFDs enable traders to speculate on the collective performance of a group of oil-related assets, similar to an oil ETF, without owning the actual ETF. These CFDs mirror the price movements of oil ETFs, providing a means for traders to access a varied range of oil assets in one transaction.

Oil Stock CFDs

Oil stock CFDs enable traders to speculate on the price movements of individual oil company stocks without owning the shares. Traders can take positions on the performance of major oil companies, capitalising on price movements based on market analysis and industry trends.

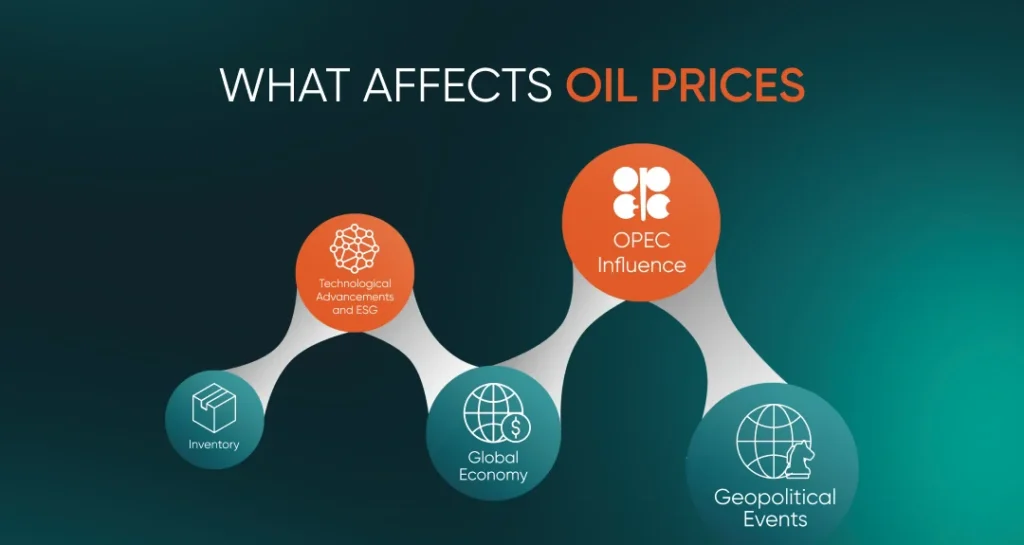

What Affects Oil Prices

Understanding what causes oil prices to go up or down is crucial in the global economic landscape. Here are some factors that affect oil prices:

1. The influence of OPEC

The Organisation of Petroleum Exporting Countries (OPEC), along with partners such as Russia under the OPEC+ alliance, significantly impacts global oil prices by controlling crude oil supply.

Although US shale production once posed a challenge, OPEC’s influence in the oil industry still holds strong. The decisions made by OPEC are keenly observed by governments and industry experts and are often influenced by the political situations in its member countries.

For example, during the 2020 pandemic, members of the OPEC+ alliance, which includes OPEC members and other oil producers, failed to quickly agree on cutting oil production. This led to some producers, notably Saudi Arabia and Russia, briefly flooding the market. As oil demand began to collapse with the onset of global lockdowns, Brent crude oil prices plummeted. They closed at $9.12 a barrel on 21 April 2020, significantly lower than the $70 a barrel price at the beginning of the year [1].

2. Global Economy

The performance of the global economy is another critical factor that affects oil prices. When the world economy is strong, the demand for oil typically increases as industries expand and transportation needs grow. This heightened demand often leads to higher oil prices.

Conversely, in times of economic recession or slowdown, the demand for oil tends to decrease, resulting in lower prices.

For instance, the global financial crisis of 2008, and the Great Recession that followed, saw a significant drop in oil prices due to reduced industrial activity and transportation needs. Oil prices dropped from a high of $133.88 in June 2008 to $39.09 in February 2009 [2].

Additionally, economic indicators such as GDP growth, industrial production, and consumer spending can also provide insights into future trends in oil demand and prices.

3. Geopolitical Events

Geopolitical events play a substantial influence on oil prices. Conflicts or disagreements among key oil-producing countries or regions can cause interruptions in oil supply, leading to market instability. The oil market is particularly sensitive to these geopolitical shifts as they can rapidly change the equilibrium of oil supply and demand.

A notable example of this effect was observed during the Russia-Ukraine conflict in early 2022, which resulted in a swift increase in oil prices. On 7 March 2022, WTI crude oil futures reached $133.46 per barrel, and Brent crude oil futures climbed to $139.13 per barrel, marking the highest prices since July 2008 [3].

4. Technological Advancements and ESG

Technological advancements can also play its role in influencing oil prices by altering production efficiency and market accessibility.

Innovations in extraction and drilling technologies, such as hydraulic fracturing or ‘fracking’, have dramatically increased oil production capabilities, particularly in regions like the US. This surge in production, especially from previously inaccessible reserves, can lead to an oversupply in the market, thereby reducing oil prices.

On the other hand, advancements in renewable energy technologies and increased efficiency in electric vehicles are contributing to a gradual shift away from oil dependence. As these technologies become more widespread and cost-effective, the demand for oil could see a long-term decline, potentially leading to lower prices.

5. Inventories

Oil inventories, or stored reserves of crude oil and its products, will be another factor that influences oil prices. These inventories act as a buffer against supply disruptions and demand fluctuations.

When inventories are high, it indicates an oversupply in the market, often leading to lower oil prices as there is ample stock available to meet demand. Conversely, low inventory levels can signal a shortage in supply, potentially driving up oil prices due to increased competition for available resources.

Inventory data, frequently reported by organisations like the US Energy Information Administration (EIA), is closely monitored by market participants. Sudden changes in inventory levels, whether due to strategic decisions by countries or companies, or unexpected events affecting production and distribution, can have effects on oil prices.

Trading Crude Oil

Crude oil is unrefined petroleum that is extracted from the earth and is a key product of the global commodity market. It serves as the primary source to make gasoline, diesel, and other petrochemicals which are essential in industries and transportation making crude oil a highly sought-after asset.

The trading of crude oil goes beyond its physical barrels, encompassing a range of financial instruments such as futures contracts, options, ETFs, and CFDs. This allows market participants to engage in crude oil trading through online trading. The flexibility and accessibility of these platforms make oil trading appealing to a wide variety of traders and investors, enhancing its attractiveness in the financial market.

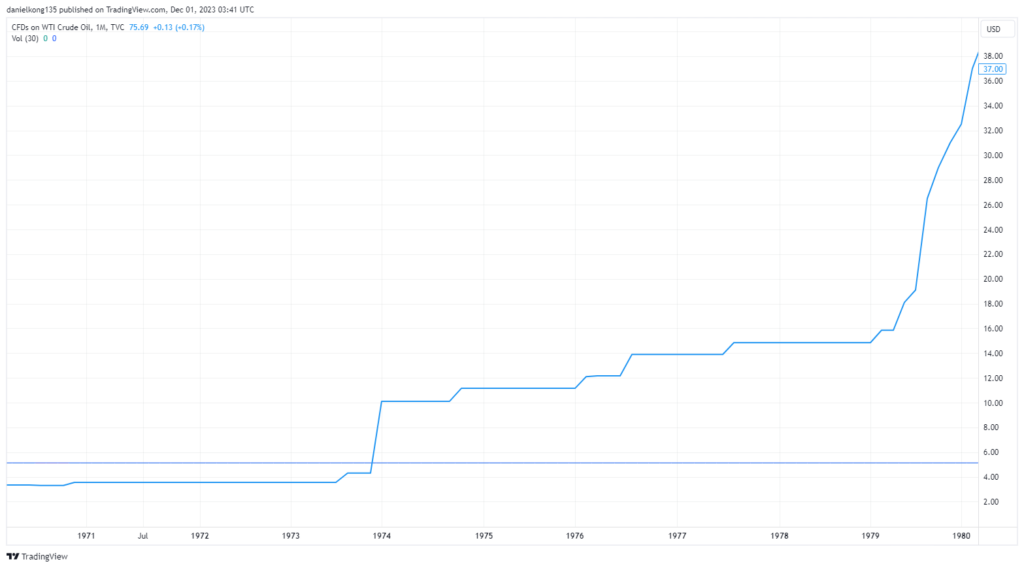

Image 1: Historical price of oil from 1970-2023

The historical price of crude oil is shaped by a blend of economic and geopolitical events impacting the market. When OPEC was established in 1960, it gave oil-producing countries greater control over oil supply.

This influence was evident during the 1973 OPEC oil embargo, which led to a significant energy crisis and a dramatic rise in oil prices. Prior to the embargo, oil was priced at about $2.90 per barrel, but by January 1974, it had surged to $11.65 per barrel, showcasing a substantial fourfold increase [4].

Image 2: Historical price of oil from 1970-1980

The 1979 Iranian Revolution further exacerbated the situation, leading to another price surge. In the 1980s, oil prices experienced a period of decline due to increased supply and economic recession. During this tumultuous period, oil prices escalated from a low in mid-1979 to a peak per barrel by mid-1980, reflecting the market’s volatility and sensitivity to global events.

Image 3: Historical price of oil from 2000-2015

The financial crisis of 2008 initially led to a decrease in oil prices, but they soon rebounded, hitting record levels in 2008 and 2014, followed by a decline. Since that time, oil prices have experienced significant fluctuations, driven by a mix of geopolitical incidents, technological progress, and varying economic circumstances.

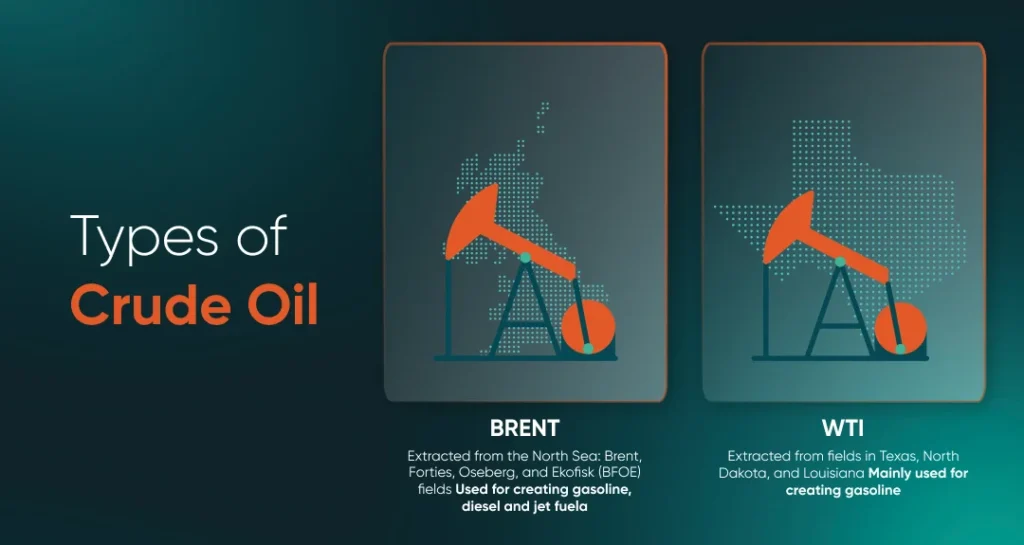

Types of Crude Oil

Let’s explore some of the most prominent types, including Brent Crude Oil and West Texas Intermediate (WTI) Crude Oil.

Brent Crude Oil

Brent Crude oil, a key type of oil, is extracted from the North Sea, specifically between the Shetland Islands and Norway. This oil blend includes crude from multiple North Sea sites, like Brent, Forties, Oseberg, and Ekofisk fields. It’s well-known for qualities that make it ideal for creating gasoline and other important products like diesel and jet fuel.

West Texas Intermediate (WTI) Crude Oil

WTI Crude oil, known for its low density and sulphur content, is a “sweet” crude oil. Mainly transformed into gasoline, it’s extracted from fields in Texas, North Dakota, and Louisiana, with a significant trading hub in Cushing, Oklahoma. WTI’s high quality makes it a sought-after item in the global market, competing with Brent Crude as a major pricing benchmark.

For a more in-depth understanding of the differences and significance of Brent Crude Oil and WTI Crude Oil, visit the Vantage Academy page to read a detailed article comparing these two types of crude oil.

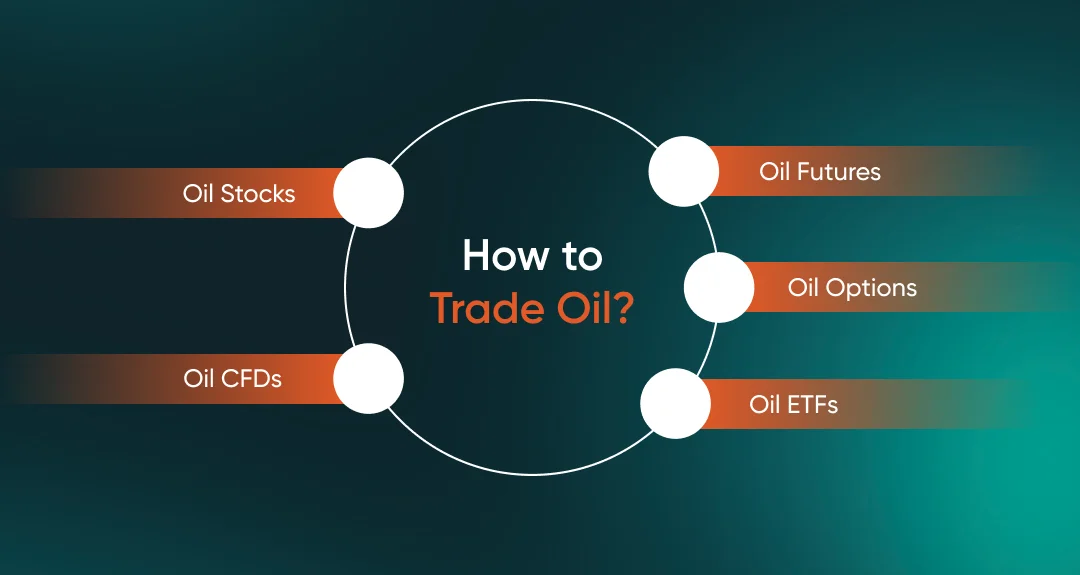

How to Trade Oil

Investors and traders have the option to use the diverse financial instruments listed below to take advantage of oil price fluctuations by trading. Each financial product is designed to suit various levels of risk tolerance and trading strategies.

Here’s a quick breakdown of the steps to start oil trading:

Start Oil Trading

1. Open a Live Trading Account

If you’re keen on trading oil, the first step is to open a live trading account with a broker.

This account gives you access to the oil market and the ability to make trades. Remember, trading through a broker often involves fees. In oil trading, a critical fee to be aware of is the ‘spread’ – the gap between the selling and buying prices. Knowing the spread is vital as it can influence the potential profits from your trades.

Choosing the right broker is also important. Different brokers have various fees, tools, and resources that can affect how you trade. Look for a broker that offers not just an easy-to-use platform and dependable support but also educational materials to deepen your understanding of trading.

2. Choose Oil Assets to Trade

After setting up your trading account, the next step is to decide which oil assets you want to trade. You have several options, each catering to different trading styles and objectives. Here’s a brief overview:

Brent Crude Oil: One of the major oil benchmarks globally, Brent Crude is ideal for traders looking to engage with international oil markets.

WTI Crude Oil: West Texas Intermediate is another primary benchmark, often preferred by traders focusing on the American market due to its sourcing from US oil fields.

Cash CFDs: These allow traders to speculate on the price movements of oil without actually owning the physical commodity.

Futures CFDs: These are agreements to buy or sell oil at a predetermined price on a specific future date.

ETF CFDs: These are funds that track the performance of oil and oil-related indexes, suitable for those who prefer a diversified approach to oil trading.

Oil Stock CFDs: This involves trading the stocks of companies involved in the oil industry. It’s a way to gain exposure to the oil market indirectly and is suitable for traders who are also interested in the corporate aspect of the oil industry.

By understanding the characteristics and risks associated with each type of oil asset, you can make a more informed decision that aligns with your trading goals and risk tolerance. Remember, each type of oil asset has its own set of market dynamics, so thorough research and a clear trading strategy are essential for successful trading.

3. Research and Analyse the Oil Market

Embarking on oil trading requires a keen understanding of the market dynamics. Stay updated with global news, especially events that could impact oil prices, such as political shifts in oil-producing nations or changes in energy policies.

It’s also crucial to monitor supply and demand trends, keeping an eye on factors like OPEC’s production decisions or developments in alternative energy sources. Analysing these aspects helps traders to gauge the market’s pulse and make well-informed decisions.

In addition to staying informed, leveraging technical analysis to scrutinize market trends and historical price patterns is a prudent strategy. Pay attention to key economic indicators like GDP growth, currency strength, and inflation, as these can indirectly affect oil prices.

4. Build Oil Trading Strategies

Developing effective trading strategies is the final step before placing any trades. Start by setting clear goals and defining your risk tolerance. Your strategy should reflect your objectives and comfort level of risk, whether it’s for short-term trading or long-term trading.

Incorporate both technical and fundamental analysis to make balanced decisions. Technical analysis helps you understand price trends and patterns, while fundamental analysis gives insights into broader market factors like geopolitical events and supply-demand dynamics. Remember, a flexible approach that adapts to market changes is often more effective than a rigid strategy.

Trading Oil Using Fundamental Analysis

Understanding the nuances of fundamental analysis is essential in oil trading, as it involves analysing key economic and geopolitical events that significantly influence oil prices. One classic example is the decisions made by the OPEC regarding oil production quotas. These decisions can have a direct and immediate impact on global oil prices.

For instance, when OPEC decides to reduce oil production, the supply decreases, leading to a price hike. Conversely, an increase in production quotas can result in a drop in oil prices due to a higher supply in the market.

Traders closely monitor OPEC meetings and statements as their outcomes are often key indicators of future price movements. An example of this dynamic occurred on 2 April 2023, when OPEC and its allies, including Russia, unexpectedly agreed to extend crude oil production cuts to 3.66 million barrels per day, accounting for about 3.7% of global demand. This unforeseen decision catalysed a surge in oil prices, with an increase of $5 per barrel, pushing prices above $85 per barrel [5].

Trading Oil Using Technical Analysis

Technical analysis serves as a method that investors and traders can use to forecast oil price movements through historical market data. This technique involves an in-depth analysis of price charts, employing a range of technical indicators to identify market patterns and trends. For instance, examining the historical price fluctuations of benchmarks such as WTI or Brent Crude oil can aid in making informed predictions about their future trajectories.

Several technical analysis indicators are particularly useful in oil trading:

- The Moving Average (MA) is effective in smoothing out price data over a designated period, thus providing a clearer perspective on the direction of the trend.

- The Relative Strength Index (RSI) is another critical tool that helps determine whether oil is overbought or oversold, offering valuable insights for forecasting potential market turns.

- Traders also often use Bollinger Bands to gauge market volatility, with a convergence of these bands typically indicating a likely significant price movement.

By combining these indicators, traders can form a more comprehensive picture of the market, enhancing their decision-making process in oil trading.

Risk Management

In the dynamic and often unpredictable realm of crude oil trading, risk management is an essential practice that involves identifying, quantifying, and mitigating potential risks. This aspect of trading is crucial due to the significant opportunities and equally substantial risks inherent in the oil market. These risks can be magnified, especially when trading on leverage.

There are a handful of risk management strategies and tools traders can employ. These include setting stop-loss orders to limit losses to a predetermined level, diversifying your investment portfolio across different oil assets or markets, and adhering to a rule of not risking more than a certain percentage of their trading capital on any single trade.

By having adequate risk management principles in place, traders can safeguard their capital and improve their chances for long-term success in the volatile world of oil trading.

Oil Trading Strategies

When it comes to oil trading, there is no one-size-fits-all strategy for all traders. Here are some of the oil trading strategies aspiring oil traders can consider.

Day Trading [6]

Day trading in oil markets involves executing trades within the same day, focusing on short-term price movements.

Traders in this space need to be quick and make swift decisions based on real-time market analysis. Utilising technical indicators and closely monitoring news that can impact oil prices, day traders aim to make returns from the volatility by buying and selling oil contracts within a single trading session.

Position Trading [7]

Position trading in oil involves holding trades for a longer duration, ranging from several days to months, to capitalise on significant market trends.

This strategy requires a deep understanding of market fundamentals, including supply-demand dynamics and geopolitical factors affecting oil prices. Position traders often use a mix of technical and fundamental analysis to identify and maintain positions that align with long-term market movements.

Swing Trading [8]

Swing trading in oil focuses on capturing price movements over a short to medium term, typically from a few days to several weeks. Swing traders seek to take advantage of “swings” or changes in oil prices, using a combination of technical analysis and market indicators to gauge potential entry and exit points.

This approach balances the quick decision-making of day trading with the trend analysis of position trading.

Trend Following [9]

Trend following in oil trading is a strategy that involves identifying and riding prevailing market trends, whether upward (bullish) or downward (bearish).

Traders using this approach utilise technical analysis tools like moving averages to detect and follow these trends. Once a trend is identified, traders seek to enter the market in the direction of the trend and stay in the trade until there are indications that the trend might be reversing or losing momentum.

Sentiment Trading [10]

Sentiment trading in oil markets involves gauging the overall mood or sentiment of the market and making trades based on this collective consensus of the market.

Traders analyse various indicators, including market commentary, investor behaviour, and broader economic factors, to understand the market sentiment. Some brokers also offer market sentiment tools, which can help traders by aggregating and quantifying these indicators. These tools often provide a more structured and data-driven way to assess the market’s overall sentiment.

News Trading [11]

News trading in the oil sector focuses on reacting to significant news events that can influence oil prices, such as changes in OPEC policies, geopolitical events, or supply disruptions.

Traders employing this strategy stay well-informed and ready to act quickly on news that can cause immediate price movements, aiming to exploit these short-term opportunities for returns. This approach requires a keen understanding of how different types of news can impact the oil market.

Best Time to Trade Oil

The optimal time for trading oil can vary significantly depending on several factors, including seasonal influences and individual trading strategies.

Seasonal patterns often play a critical role in oil prices. For instance, demand for oil typically increases during winter in the northern hemisphere due to heating needs, and during summer for gasoline consumption. This spike in demand can lead to higher oil prices, presenting potential opportunities for traders.

Conversely, the summer months often bring about a different kind of demand surge, particularly in gasoline consumption. This is due to the summer driving season, when travel and tourism activities usually peak, resulting in higher gasoline usage. The seasonal increase in demand for gasoline can also cause oil prices to rise.

Your chosen trading strategy also dictates the best time to engage in oil trading. Day traders, for example, might find more opportunities during periods of high market volatility, while long-term position traders may focus on broader trends irrespective of short-term fluctuations.

Understanding these factors and aligning them with your trading approach is key to determining the best time to trade oil, ensuring that your trading decisions are both timely and in tune with the overall market dynamics.

Key Takeaways for Oil Trading

Oil trading is a multifaceted market influenced by geopolitical events, global economic trends, and OPEC decisions, requiring traders to be well-informed and adaptable. Seasonal demand changes offer distinct opportunities, while a range of financial instruments like futures, options, ETFs, and CFDs cater to various investment strategies.

Effective risk management, including diversifying portfolios and setting stop-loss orders, is also essential in navigating this volatile market. Traders must align their strategies—be it day trading, position trading, or other approaches—with their objectives and the market’s dynamics to achieve the best trading outcome.

FAQs for Oil Trading

What are the Spreads on Oil Assets at Vantage?

At Vantage, traders have the advantage of accessing highly competitive spreads on oil assets, starting from as low as 0.0. This feature enables traders to engage in oil trading, including popular products like Brent Crude Oil, WTI Crude Oil, Gasoline, and Gas Oil, at minimal costs.

What are the Popular Oil Trading Platforms at Vantage?

Vantage provides traders with a selection of robust and user-friendly platforms for oil trading, catering to various trading preferences and styles. These include the widely acclaimed MetaTrader 4 and MetaTrader 5 platforms, known for their advanced tools and customisable features. Additionally, traders can leverage the analytical capabilities of TradingView.

For those who prefer trading on-the-go, the Vantage App offers a seamless mobile trading experience, combining convenience with comprehensive functionality. Each of these platforms is designed to facilitate effective trading strategies in the dynamic oil market for all types of traders.

What are the Risks of Oil Trading?

Oil trading, while offering potential for significant returns, carries inherent risks. The oil market is known for its volatility, with prices often influenced by geopolitical events, supply and demand dynamics, and global economic trends. Traders must also be aware of the risk of leverage, which can amplify both gains and losses when trading using derivatives such as CFDs.

Moreover, the evolving landscape of energy policies and the transition towards renewable energy sources can impact long-term oil prices and market stability. It is, therefore, crucial for traders to stay informed and apply proper risk management techniques to help mitigate these risks effectively.

What are the Additional Tips for Trading Oil?

When it comes to oil trading, it’s important to be updated with all the latest global economic news and geopolitical events, as they play a role in influencing oil prices. Diversifying your trading strategy to include both technical analysis and fundamental analysis can help to provide a more comprehensive market perspective.

Setting realistic profit targets and stop-loss orders can help manage risks effectively. Additionally, continuously educating yourself about the oil market and its trends is another tip to help improve your trading decisions.

What are the Oil Trading Market Hours?

Oil trading markets typically operate nearly 24 hours a day, five days a week, due to their global nature and the involvement of international exchanges. These extended hours allow traders worldwide to trade oil at almost any time, accommodating various international time zones.

Can I Practise Oil Trading?

Absolutely! Practising oil trading is possible through a demo account. Vantage offers traders a simple and quick way to open a demo account where you can trade with virtual funds up to $100,000.

This simulated trading environment is ideal for refining trading skills and gaining familiarity with the platform’s features without any financial risk. Once you feel confident and ready, transitioning to live trading is straightforward – just switch over to your live account for real market experience.

Demo accounts are also not limited to beginners. Experienced traders can also trade on demo accounts to try out new trading strategies, tools or ideas, without incurring any real-world financial losses.

References

- “What Happened to Oil Prices in 2020 – Investopedia” https://www.investopedia.com/articles/investing/100615/will-oil-prices-go-2017.asp Accessed 28 Nov 2023

- “The 2008 Financial Crisis and Its Effects on Gas and Oil – Investopedia” https://www.investopedia.com/ask/answers/052715/how-did-financial-crisis-affect-oil-and-gas-sector.asp Accessed 28 Nov 2023

- “Unveiling the impact of geopolitical conflict on oil prices: A case study of the Russia-Ukraine War and its channels – ScienceDirect” https://www.sciencedirect.com/science/article/abs/pii/S0140988323004541 Accessed 28 Nov 2023

- “1973 Energy Crisis: Causes and Effects – Investopedia” https://www.investopedia.com/1973-energy-crisis-definition-5222090 Accessed 28 Nov 2023

- “Why did OPEC cut oil production? Key reasons explained – Reuters” https://www.reuters.com/business/energy/why-is-opec-cutting-oil-output-2023-04-03/ Accessed 29 Nov 2023

- “Day Trading: The Basics and How to Get Started – Investopedia” https://www.investopedia.com/articles/trading/05/011705.asp Accessed 29 Nov 2023

- “Position Trader Definition, Strategies, Pros and Cons – Investopedia” https://www.investopedia.com/terms/p/positiontrader.asp Accessed 29 Nov 2023

- “Swing Trading: Definition and the Pros and Cons for Investors – Investopedia” https://www.investopedia.com/terms/s/swingtrading.asp Accessed 29 Nov 2023

- “Trend Trading: Definition and How Strategy Aims For Profit – Investopedia” https://www.investopedia.com/terms/t/trendtrading.asp Accessed 29 Nov 2023

- “What Is Market Sentiment? Definition, Indicator Types, and Example – Investopedia” https://www.investopedia.com/terms/m/marketsentiment.asp Accessed 29 Nov 2023

- “What Is a News Trader? ‘Buy the Rumor, Sell the News’ Explained – Investopedia” https://www.investopedia.com/terms/n/news-trader.asp Accessed 29 Nov 2023